Compliance Pressure in the Banking Sector

Banks today operate in an environment of c...

The High Stakes of Banking Due Diligence

In today’s financial ecosystem, banks...

The Banking Sector’s Growing Legal Challenges

Banks and financial institutions...

Trending Topics

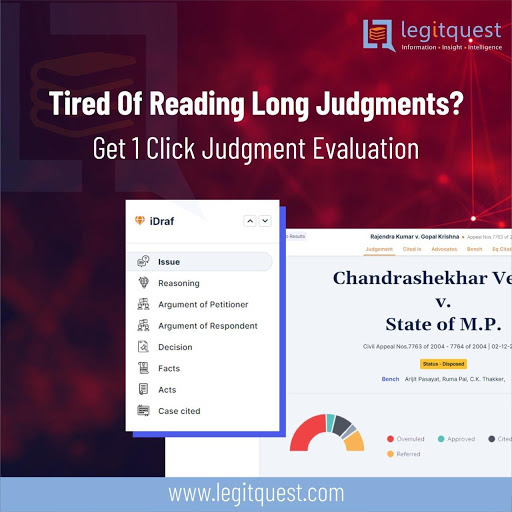

The latest news, technologies, and resources from our team.

What is Section 506 IPC?

Section 506 IPC says that “Whoever commits, the offence of criminal intimidation shall be punished...

What is Section 471 IPC?

Section 471 IPC says that “Whoever fraudulently or dishonestly uses as genuine any document or...

As per the recent report of Hindu.com, over 2300 domestic violence complaints were filed with the National commission for Women...

Recommended

-

1

-

2

-

3

-

4

Other Topics Channels

Latest Blog Posts

The latest news, technologies, and resources from our team.

Trending Blogs

The latest news, technologies, and resources from our team.

.png)

.jpg)