Why insurers choose LIBIL for legal due diligence

-

Underwriting grade signals

surface litigation, injunctions, attachment orders and judgments that affect risk pricing and acceptability. -

Claims defense and fraud detection

link FIRs, enforcement actions and repeated filings to help validate claims and identify suspicious patterns. -

Reinsurance and counterparty checks

run subject and entity level checks on brokers, reinsurers and large counterparties to reduce transfer risk. -

Scalable with auditability

Instant Reports for bulk screening and Detailed Reports with scored matches, extracts and narratives for regulatory and audit needs. -

Seamless integrations

APIs, batch upload and a client portal so checks fit into underwriting, claims and fraud workflows.

How legal due diligence works

-

Provide identifiers such as name, company name, PAN, DIN, GST or address to improve match accuracy.

-

Choose Instant for speedy triage or Detailed for transaction and claims grade reports.

-

Our system searches courts, tribunals, FIRs and institutional lists, applies multi identifier matching and returns ranked matches with extracts, links and confidence scores.

-

Export the report, attach it to the policy file or claim folder, and escalate material hits to legal or investigation teams.

LIBIL - Litigation Check Reports

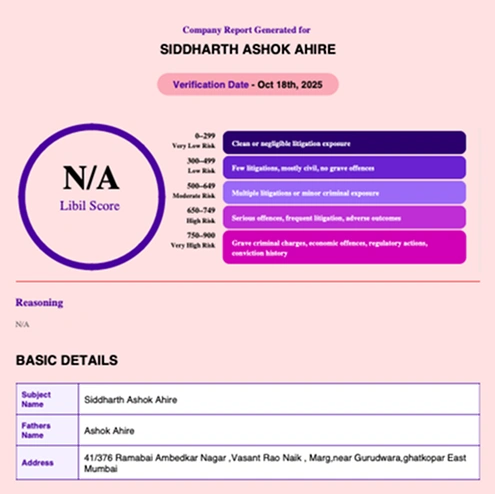

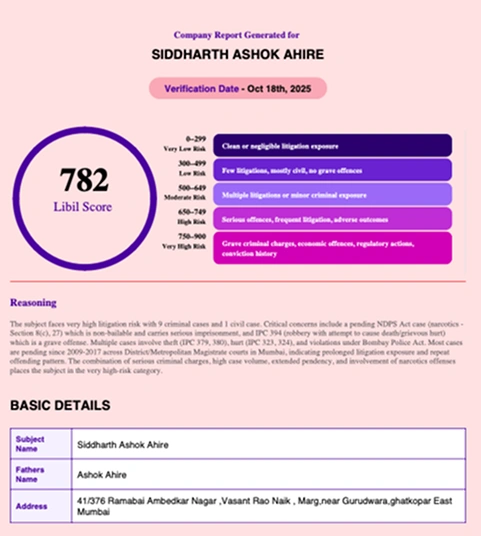

Instant Check

-

Turnaround: 1 to 2 minutes

-

Best for: high volume screening

-

Output: top litigation and FIR signals with basic summaries

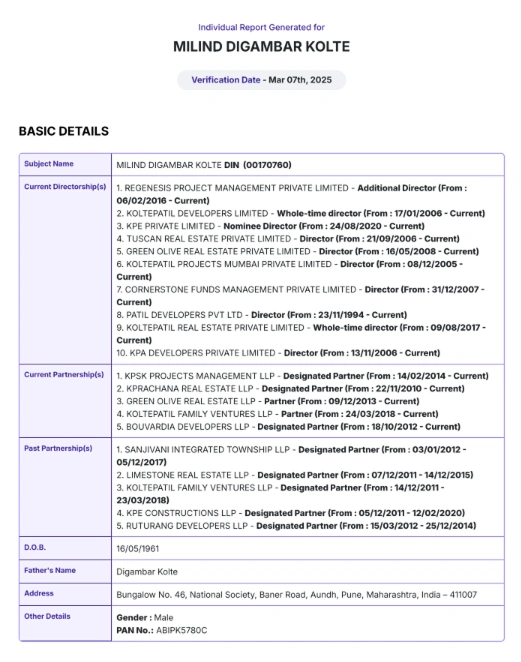

Detailed Report

-

Turnaround: about 2 hours

-

Best for: escalations, senior hires and client audits

-

Output: LIBIL Score, match confidence, case summaries and source links

Manual Verification

-

Analyst reviewed

-

Used for leadership roles, regulated industries and sensitive access

-

Disclosure grade reporting

Litigation Checks for insurance teams

Underwriting and risk pricing

include litigation exposure in risk assessments and premium decisions for complex products.

Claims validation and disputes

surface prior litigation or criminal filings that inform liability, subrogation or repudiation decisions.

Fraud detection and investigations

map patterns across claims, repeated addresses and aliases to spot fraud rings.

Reinsurance and counterparty assessment

run due diligence on brokers, reinsurers, TPAs and vendors before contracting.

Regulatory and audit readiness

attach timestamped reports and narratives to files for insurer audits and regulator inquiries.

Trusted by the top names in the industry

Press & Recognitions

Ready to add legal due diligence to your underwriting and claims workflows?

FAQs

For Insurance Companies: LIBIL, PATROL & Legal Research Tool by LegitQuest

Insurance providers manage high volumes of claims and regulatory requirements, making streamlined legal processes essential. Legal tech for insurance company solutions help improve documentation, collaboration, and reporting accuracy. Firms working with property portfolios can complement workflows using real estate law firm software.

For deeper risk screening, integrating criminal background verification strengthens trust and supports more informed decisions.