Why LIBIL

Unrivalled coverage

400M+ court and tribunal records across Supreme Court, all High Courts, district courts and major tribunals, plus institutional lists. FIR coverage of over 4M+ records.

Designed for commercial decisions:

Built for legal, investment, credit and financial crime investigations teams who need litigation check outputs that map to valuation, disclosure and credit decisions.

Flexible delivery

Instant API for high throughput screening, Detailed API for scored narrative reports, and bespoke manual IPO Reports for prospectus-grade disclosure.

Core Capabilities

-

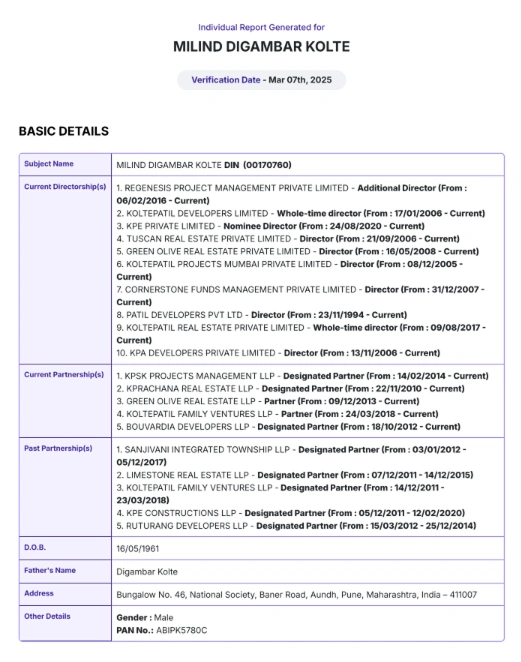

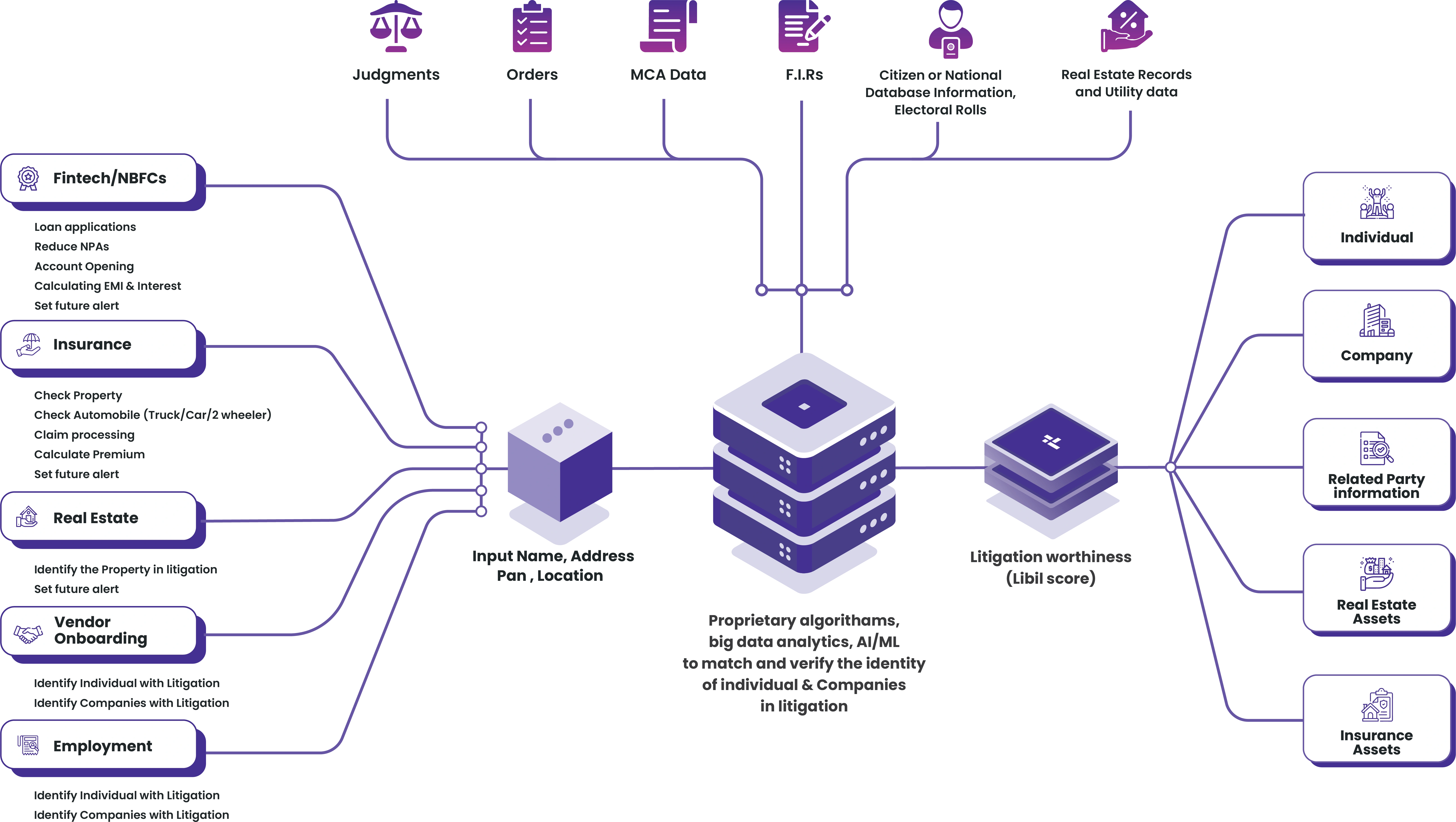

Comprehensive litigation search by name, father name, address, aliases and entity identifiers across India’s courts and tribunals.

-

FIR and enforcement checks integrated with court data to flag criminal or enforcement exposure, enabling forensic investigations and criminal background screening.

-

Defaulter and regulator watch from credit bureaus and institutional lists to provide consolidated enterprise risk mitigation signals.

-

Automated scoring and case match metrics to prioritise risk in underwriting and due diligence workflows.

-

Narrative reasoning in Detailed and IPO reports that explains why a record matters to a transaction or credit decision.

-

APIs and client portal with audit logs, exports, team access controls and historical search storage for compliance and scale.

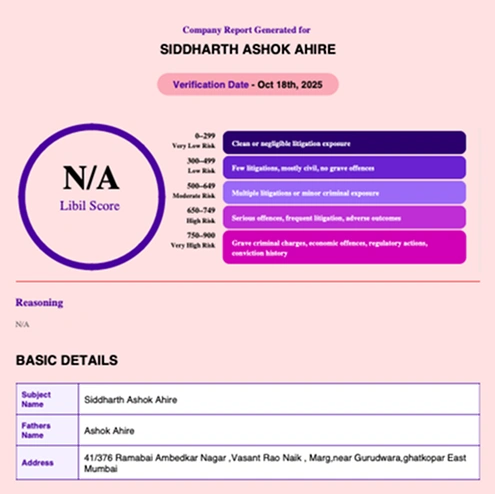

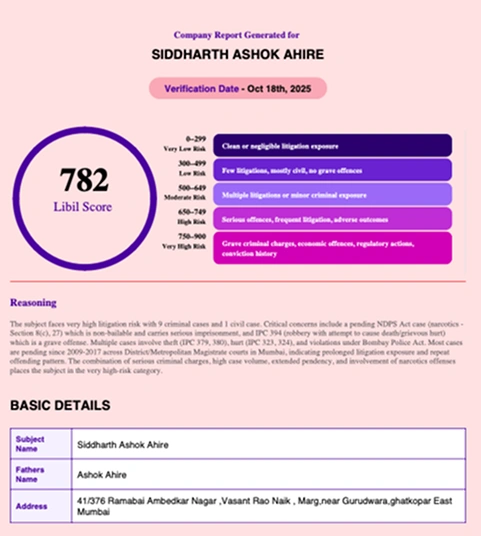

LIBIL - Litigation Check Reports

Instant Report: Speed First

-

Turnaround time 1 to 2 minutes. Basic case summaries for large scale onboarding and high throughput background check service. Use for initial prescreening and fast BGV workflows.

Detailed Report: scored and narrative

-

Turnaround time approximately 2 hours. Includes LIBIL Score, case match scoring, detailed summaries and narrative reasoning to support credit memos, legal memos and investigations. Ideal for deeper background verification and forensic investigations.

IPO Report: manual, disclosure grade

-

Analyst-prepared report with full manual review and narrative for prospectus schedules, regulator responses and underwriting sign-offs. Tailored to transaction scope.

How LIBIL Enhances Case Evaluation and Decision-Making

Boost accuracy with real-time scoring, actionable metrics, and predictive analytics for more informed legal strategies.

Use Case Playbooks

M&A Due Diligence

Goal: surface litigation and enforcement liabilities that affect valuation, indemnities or deal structure.

How: run Detailed Reports on target, promoters and related parties; use LIBIL Score and case match score to prioritise issues and export case summaries for disclosure schedules.

IPO Due Diligence

Goal: prepare disclosure-ready litigation schedules and identify remedial or disclosure needs.

How: commission the manual IPO Report for deep review and supplement with Detailed API for bulk filing teams.

Lending and Credit Underwriting

Goal: detect litigation, enforcement and defaulter signals tied to borrowers, promoters or guarantors.

How: use Instant Reports for lead-level pre-screening and Detailed Reports for large ticket or borderline credits. LIBIL outputs feed risk management tools and credit decision engines.

Financial Crime Investigation

Goal: trace litigation exposure, FIRs and enforcement actions linked to people, entities and assets.

How: run Detailed Reports, use father name and address matching to build entity networks and export case summaries for investigative files. LIBIL supports forensic investigations with FIR and tribunal linkages.

Background Checks and Onboarding

Goal: scale hire, vendor and onboarding screening across risk tiers for regulatory KYC and litigation checks.

How: run Instant Reports at scale. Escalate hits to Detailed Reports for legal review. LIBIL becomes a core component of background verification and BGV workflows.

Trusted by the top names in the industry

Press & Recognitions

Ready to reduce blind spots in deals, hirings and credit?

LIBIL delivers litigation checks that stand up to scrutiny, scale with volume and protect reputation.

FAQs

Our Legal AI Research FAQ addresses key questions about our work in advancing AI for legal applications, ensuring accuracy, efficiency, and ethical compliance.

Smarter Legal Workflows, Built on Strong Due Diligence

Legal due diligence plays a critical role in building confidence around the people, entities, and matters you engage with. Whether you are onboarding a new client, assessing a counterparty, or preparing for litigation, having reliable information at the outset helps reduce uncertainty and supports better decision-making. Strong due diligence creates a solid foundation, but its true value is realized only when that information is carried forward into day-to-day legal work.

Once that foundation is in place, managing related matters efficiently becomes essential. Legal teams often deal with multiple cases, overlapping deadlines, and large volumes of documents, all of which need to remain connected to the original diligence findings. This is where law firm case management software like Patrol becomes central to the workflow. By bringing matters, timelines, and documents into a single system, it helps teams maintain clarity and control across every stage of a case. Instead of juggling spreadsheets, emails, and folders, legal professionals can rely on one organized workspace that keeps everything aligned and accessible.

As matters progress, legal research continues to play an important supporting role. While building diligence reports or preparing case strategies, teams often need quick access to judgments, statutes, and relevant case insights. Searching across multiple sources or switching between tools can disrupt focus and slow momentum. With ai legal research, the Legal Research Tool makes it easier to find precise, contextually relevant information without breaking your flow. Intelligent search capabilities help surface the right materials faster, allowing teams to move from research to action with greater efficiency.

This combination of structured case management and intelligent research creates a more connected legal workflow. Due diligence findings are not isolated documents but living inputs that inform ongoing work. Research insights are readily available when drafting, reviewing, or responding to developments. Deadlines and documents remain clearly tracked, reducing the risk of oversight and last-minute pressure.

Together, these tools support a more consistent and organized way of working. Legal teams can move smoothly from initial checks to active case management, ensuring that critical information stays linked and usable throughout the lifecycle of a matter. The result is improved coordination, better use of time, and greater confidence in both routine and high-stakes legal work.

In an environment where accuracy, speed, and accountability matter, keeping your legal workflow connected is no longer optional. By aligning due diligence, research, and matter management within a cohesive system, legal professionals can work with greater clarity, reduce operational friction, and stay focused on delivering reliable outcomes from start to finish.