Why choose our customer due diligence

-

Wide litigation coverage

searches Supreme, High, District Courts and major tribunals to minimize blind spots in customer risk checks. -

Enforcement and regulator integration

combines FIRs, defaulter lists and regulator records with court matters for deeper signal detection. -

Fast with auditability

Instant Reports for quick decisioning and Detailed Reports with scoring and narrative suitable for audit trails. -

Flexible delivery

use APIs and portal access so you can embed customer due diligence in any workflow. -

Exportable reports and logs

downloadable PDFs with audit logs and case links to support compliance and recordkeeping.

How customer due diligence works

-

Enter identifiers such as name, and optionally father name, address, PAN or Aadhaar to improve accuracy.

-

Apply filters like state, district or court type as needed.

-

Our system runs searches across structured court data, FIRs and institutional sources and returns matches, summaries and linked enforcement records where available.

-

Review the Instant or Detailed Report. Export the PDF to attach to onboarding records or compliance files. Escalate to manual review when necessary.

LIBIL - Litigation Check Reports

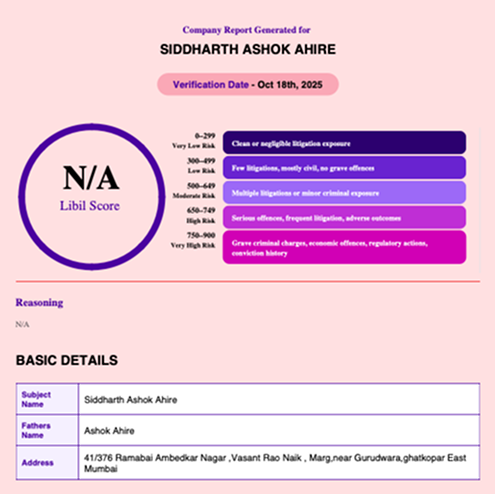

Instant Check

-

Best for: bulk onboarding, vendor screening, high throughput background checks.

-

Quick results in 1 to 2 minutes.

-

Basic case summaries and match indicators for immediate triage.

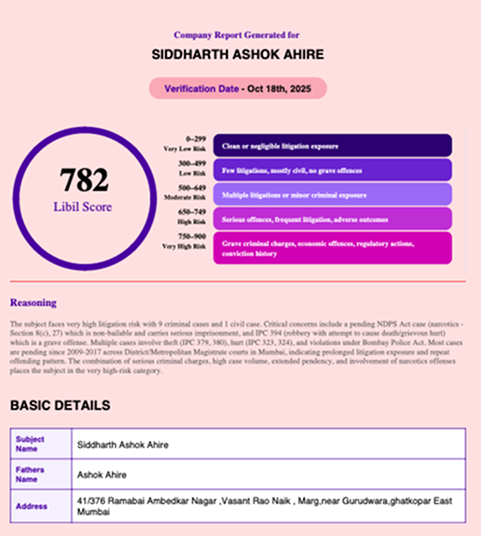

Detailed Report

-

Best for: compliance-critical hires, vendor risk escalation, investigative due diligence.

-

Includes LIBIL Score, case match scoring, narrative reasoning and detailed case summaries.

-

Typical turnaround is approximately 2 hours.

Manual Verification

-

Bespoke analyst-prepared reports for regulatory filings, IPO disclosure or deep

Use cases for customer due diligence

Onboarding and KYC

use Instant Reports for lead screening and escalate to Detailed Reports for high risk profiles.

Anti money laundering checks

Detailed Reports to help map exposure to litigation, FIRs and enforcement records.

Vendor and partner screening

screen suppliers and third parties before engagement and perform periodic rechecks.

Credit underwriting and lending

integrate scores and litigation exposure into credit decisions.

Transactional and deal diligence

run deep checks and combine narrative findings into transaction files.

Trusted by the top names in the industry

Press & Recognitions

Ready to run customer due diligence?

Qualified attorneys and legal experts employed by companies in India can request access to demonstrations and trials. Limited free trial spots are available. Provide your professional email address to receive priority access.

FAQs

Customer due diligence (CDD) refers to the process banks use to verify the identity, background, and risk level of potential and existing customers to comply with AML and KYC regulations.

LIBIL provides instant access to verified litigation data, helping banks assess legal and financial risk by checking individuals and companies across Indian courts.

Yes, LIBIL aligns with RBI, SEBI, and AML compliance frameworks. It ensures thorough due diligence as required under regulatory standards.

Absolutely. LIBIL offers API-based integration to plug into your current compliance or core banking software for seamless data access.

Most reports are generated within seconds, with actionable insights, legal flags, and summaries that reduce manual turnaround by 80%.

Yes. LIBIL is scalable and serves banks of all sizes — from national institutions to NBFCs and regional banks.

Yes, LIBIL also supports vendor onboarding and third-party legal vetting by providing litigation and asset data for companies and individuals.

Customer due diligence plays a key role in maintaining regulatory compliance and reducing financial or reputational risk. Structured workflows help teams verify identities, assess exposure, and maintain audit trails.

Organizations managing vendor ecosystems can complement checks with supplier due diligence software to maintain consistency across stakeholders. Legal departments seeking operational clarity may also benefit from law office practice management software to streamline workflows.