Why choose LIBIL for legal risk assessment

-

Audit focused outputs

reports are structured for accounting files, audit working papers and valuation memos so you get evidence that maps to professional standards. -

Court and enforcement coverage

searches across Supreme, High and District Courts, major tribunals and curated institutional lists to surface litigation and enforcement exposure. -

Fast triage and deep analysis

choose minute level Instant Assessments for large samples and Detailed Reports for transaction grade risk narratives and scoring. -

Integrates with workflows

APIs, portal access and PDF exports let you attach reports directly to audit workpapers, M&A data rooms and compliance folders. -

Traceable and exportable

timestamped reports with case links and audit logs to support documentation requirements and internal controls.

How a legal risk assessment works

-

Provide identifiers such as entity or person name and optionally PAN, DIN or address to increase precision.

-

Select Instant for high volume screening or Detailed for transaction and audit level assessment.

-

Our system searches court records, FIRs and regulator lists, applies match logic and returns ranked findings with summaries and evidence links.

-

Export the assessment to PDF and attach the narrative and score to your audit or diligence file. Escalate complex hits to analyst review if required.

LIBIL - Litigation Check Reports

Instant Check

-

Best for: bulk onboarding, vendor screening, high throughput background checks.

-

Quick results in 1 to 2 minutes.

-

Basic case summaries and match indicators for immediate triage.

Detailed Report

-

Best for: compliance-critical hires, vendor risk escalation, investigative due diligence.

-

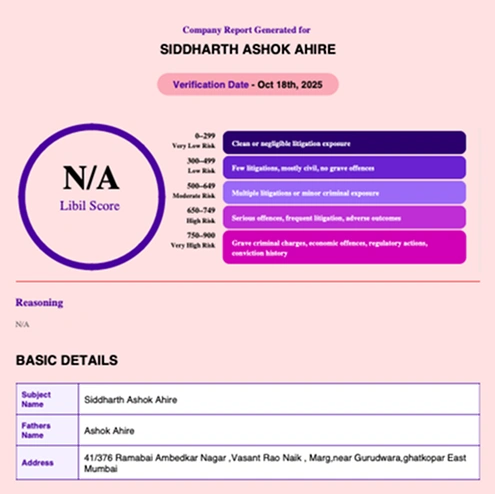

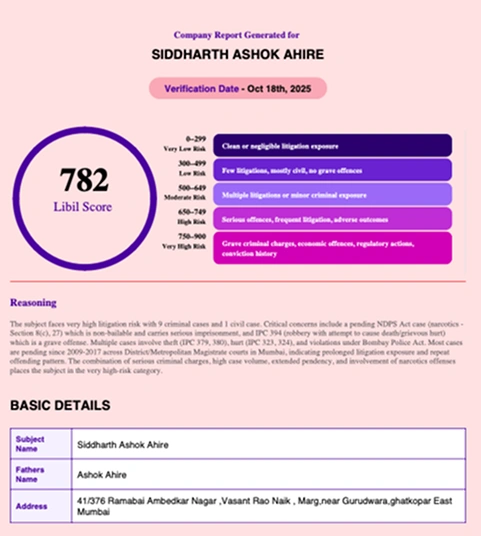

Includes LIBIL Score, case match scoring, narrative reasoning and detailed case summaries.

-

Typical turnaround is approximately 2 hours.

Manual Verification

-

Bespoke analyst-prepared reports for regulatory filings, IPO disclosure or deep investigations. Contact sales for scope and timelines.

Use cases tailored for CAs

Statutory audits and risk assessment

map litigation exposure to audit risk categories and adjust materiality or disclosures.

M&A due diligence and valuations

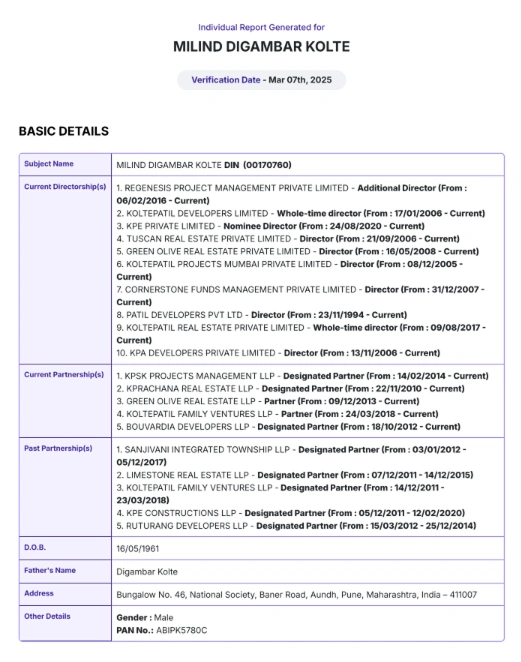

surface promoter and related party litigation that could affect deal value or disclosure schedules.

Internal controls and vendor risk

screen suppliers and advisors to support procurement and vendor management.

Credit and lending support

include legal exposure in credit memos and provisioning analysis.

Forensic accounting and investigations

build timelines and link related records for investigative work.

Trusted by the top names in the industry

Press & Recognitions

Ready to run a legal risk assessment?

Qualified attorneys and legal experts employed by companies in India can request access to demonstrations and trials. Limited free trial spots are available. Provide your professional email address to receive priority access.

FAQs

Chartered Accountants operate in environments where regulatory interpretation professional accountability and client exposure intersect closely. Legal risk assessment for CA helps professionals identify potential legal vulnerabilities linked to audits advisory services client onboarding and statutory compliance. By evaluating legal exposure early CAs can reduce professional risk and maintain stronger governance across engagements.

Risk assessment becomes more effective when supported by structured legal insight and verification. For professionals assessing clients or business relationships,due diligence in corporate law helps uncover legal exposure before advisory or compliance decisions are made. For teams that rely on authoritative interpretation of statutes and judgments, legal research tool for corporate supports accurate analysis aligned with business and regulatory context.

Together these capabilities help Chartered Accountants strengthen compliance readiness protect professional integrity and make legally informed decisions with confidence.