LIBIL - Litigation Check Reports

Instant Check

-

Best for: bulk onboarding, vendor screening, high throughput background checks.

-

Quick results in 1 to 2 minutes.

-

Basic case summaries and match indicators for immediate triage.

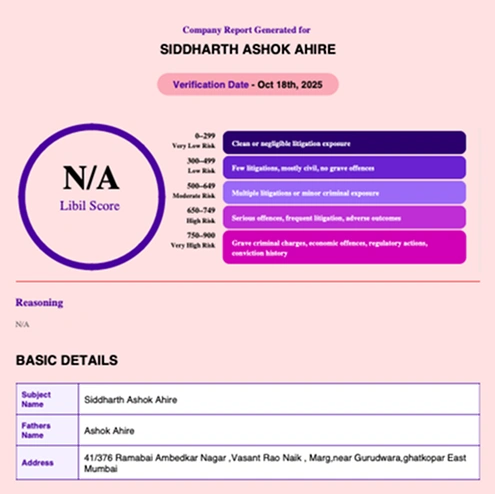

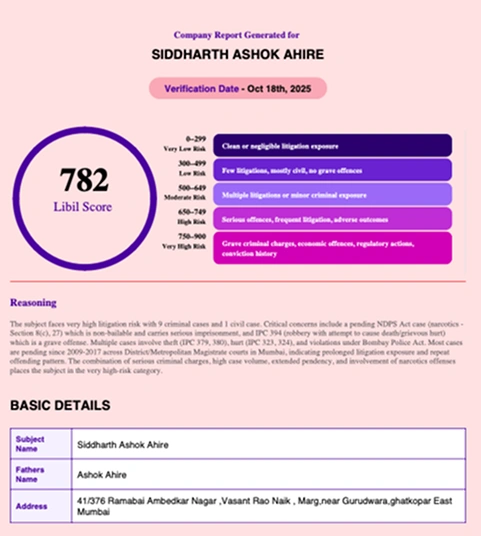

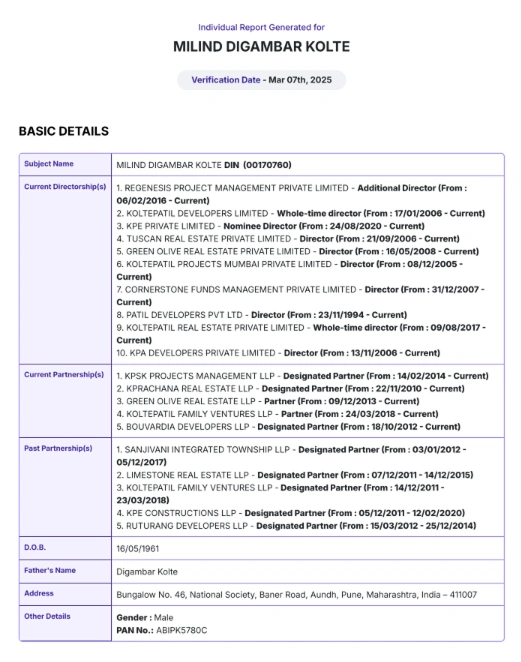

Detailed Report

-

Best for: compliance-critical hires, vendor risk escalation, investigative due diligence.

-

Includes LIBIL Score, case match scoring, narrative reasoning and detailed case summaries.

-

Typical turnaround is approximately 2 hours.

Manual Verification

-

Bespoke analyst-prepared reports for regulatory filings, IPO disclosure or deep investigations. Contact sales for scope and timelines.

Enterprise use cases

Mergers and acquisitions

run portfolio level risk assessment and convert findings into matter level remediation items.

Vendor and third party risk

automate supplier screening and escalate material exposure into case workflows.

Compliance and regulator programs

produce auditable narratives and attach evidence for regulator reporting.

HR and background programs

run scaled checks for senior hires and remediation for flagged subjects.

Credit and treasury

include litigation exposure in counterparty and portfolio risk models.

Trusted by the top names in the industry

Press & Recognitions

Ready to run a litigation check with LIBIL for enterprise risk assessment?

FAQs

Strong due diligence in corporate law enables in house legal teams to evaluate counterparties transactions and regulatory exposure with greater clarity. By structuring reviews and consolidating risk insights teams can support business decisions while maintaining compliance confidence across departments.

For legal departments managing large volumes of matters alongside diligence reviews, case management tool for enterprises helps centralize legal workstreams and improve visibility across ongoing issues. When deeper legal analysis or precedent review is required, legal research tools for lawyers provide the intelligence needed to support strategic recommendations and internal advisory work.

Bringing these capabilities together allows enterprise legal teams to move from fragmented assessments to a more coordinated and proactive legal function.