Why fintech lenders choose our legal due diligence

-

Credit-focused signals

surface litigation, judgments and enforcement actions that materially affect recoverability and provision models. -

Fast triage plus audit grade depth

use instant checks for high volume origination and Detailed Reports with scoring and narrative for borderline or high ticket cases. -

Continuous monitoring

automated rechecks for portfolio borrowers to detect new filings, judgments or enforcement steps that change credit risk. -

Integrates with credit workflows

APIs, webhooks and batch uploads let you embed checks into your loan origination and servicing systems. -

Evidence you can trust

timestamped reports, case extracts and audit logs for credit memos, provisioning and regulator responses.

How legal due diligence for credit lending works

-

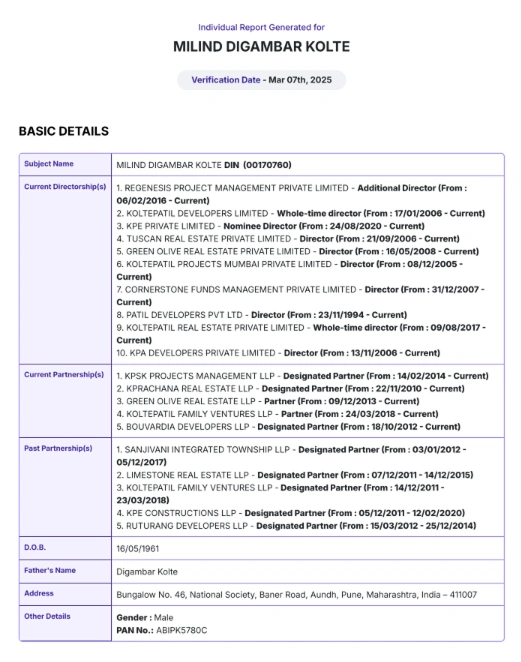

Submit borrower identifiers such as name, PAN, company registration number, DIN or address to improve match confidence.

-

Choose Instant for quick screening or Detailed for underwriting grade due diligence

-

The system searches courts, FIRs and regulator lists, applies multi identifier matching and returns ranked results with confidence scores and extracts.

-

Export the report to the credit file, attach the narrative to the approval memo, and trigger monitoring for approved borrowers.

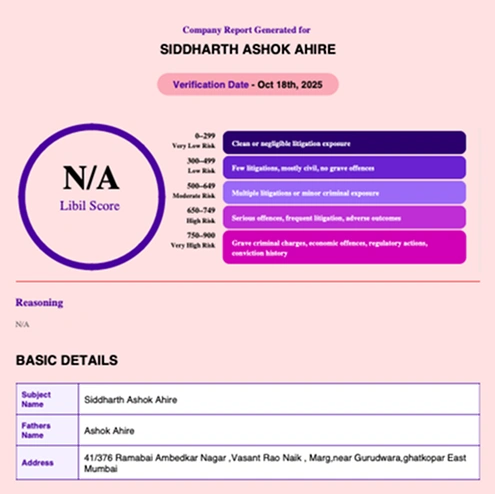

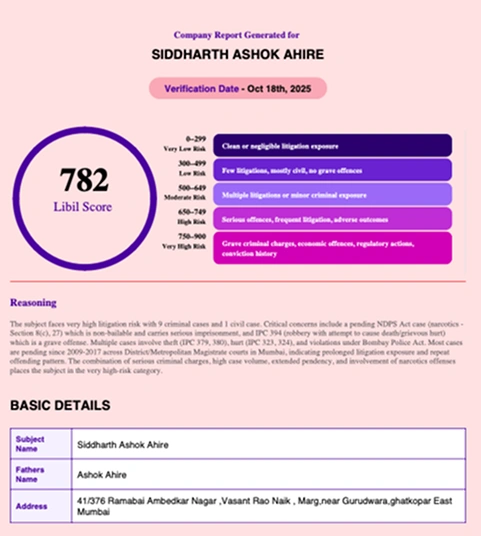

LIBIL - Litigation Check Reports

Instant Check

-

Turnaround: 1 to 2 minutes

-

Best for: high volume screening

-

Output: top litigation and FIR signals with basic summaries

Detailed Report

-

Turnaround: about 2 hours

-

Best for: escalations, senior hires and client audits

-

Output: LIBIL Score, match confidence, case summaries and source links

Manual Verification

-

Analyst reviewed

-

Used for leadership roles, regulated industries and sensitive access

-

Disclosure grade reporting

Litigation Checks to reduce NPAs

Pre sanction underwriting

include legal due diligence findings in credit memos to avoid onboarding legally encumbered borrowers.

Provisioning and reserve planning

feed litigation exposure and judgment likelihood into provisioning models and expected credit loss calculations.

Early warning and monitoring

auto alert on new filings, attachment orders or judgments and trigger underwriting or collection action.

Recovery playbooks

generate investigator grade extracts and timelines to support asset tracing, attachment and enforcement.

Portfolio remediation

run batch scans to identify concentration of litigation exposure and prioritize collection workloads.

Trusted by the top names in the industry

Press & Recognitions

Ready to reduce NPAs with credit-focused legal due diligence?

Qualified attorneys and legal experts employed by companies in India can request access to demonstrations and trials. Limited free trial spots are available. Provide your professional email address to receive priority access.

FAQs

For Fintech: LIBIL + PATROL by LegitQuest

Fintech companies face evolving regulatory expectations and rapid innovation cycles. Legal tech for fintech enables teams to manage compliance workflows, monitor exposure, and maintain audit readiness.

For identity related checks, incorporating criminal record check online can support secure onboarding processes. Enterprises scaling legal operations can also integrate corporate legal matter management software to maintain oversight across disputes and regulatory matters.