Why choose our criminal background verification

-

Comprehensive national coverage

searches Supreme Court, High Courts, District Courts and major tribunals so you reduce blind spots in candidate and vendor checks. -

FIR and enforcement linkage

surfaces FIRs, defaulter lists and regulator records together with court matters for a fuller risk picture. -

Speed and depth

pick minute level Instant Reports for volume screening or Detailed Reports with scoring and narrative for compliance and investigations. -

Seamless integrations

APIs and a client portal let you embed criminal background verification into HR, onboarding and underwriting systems. -

Audit ready outputs

downloadable PDFs with case links and exportable logs for KYC, HR files and regulatory records.

How criminal background verification works

-

Provide identifiers such as name and optionally father name, address, PAN or Aadhaar to improve match accuracy.

-

Select Instant or Detailed search depending on speed or evidence needs

-

Our system searches structured court records and institutional sources, applies match logic and returns ranked matches with summaries and links.

-

Export the report, attach it to the candidate file or escalate hits for analyst review.

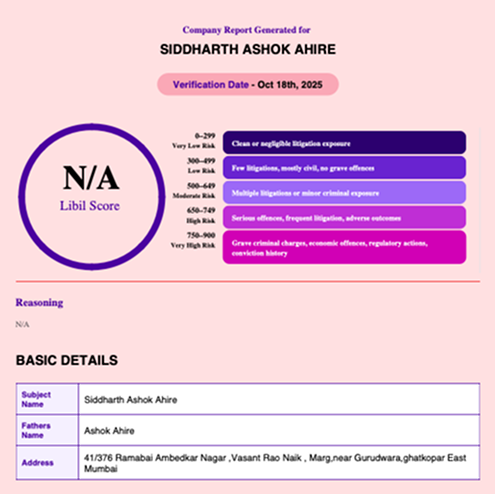

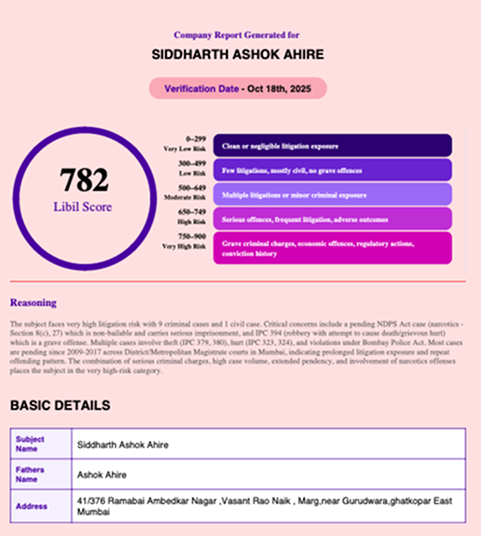

LIBIL - Litigation Check Reports

Instant Check

-

Best for: bulk onboarding, vendor screening, high throughput background checks.

-

Quick results in 1 to 2 minutes.

-

Basic case summaries and match indicators for immediate triage.

Detailed Report

-

Best for: compliance-critical hires, vendor risk escalation, investigative due diligence.

-

Includes LIBIL Score, case match scoring, narrative reasoning and detailed case summaries.

-

Typical turnaround is approximately 2 hours.

Manual Verification

-

Bespoke analyst-prepared reports for regulatory filings, IPO disclosure or deep investigations. Contact sales for scope and timelines.

Use cases

Pre employment screening

scale instant checks for volume hiring and escalate flagged profiles to Detailed Reports.

Vendor and partner checks

screen suppliers and advisors before onboarding and schedule periodic rechecks.

Lending and underwriting

include litigation and enforcement exposure in credit risk decisions.

Mergers and acquisitions

produce disclosure grade reports for promoters, directors and related parties.

Investigations and legal support

build case timelines and link related records for investigative workflows.

Trusted by the top names in the industry

Press & Recognitions

Ready to run criminal background verification?

Qualified attorneys and legal experts employed by companies in India can request access to demonstrations and trials. Limited free trial spots are available. Provide your professional email address to receive priority access.

FAQs

Criminal background verification is the process of checking an individual or entity’s history for any involvement in criminal cases or litigation. LIBIL ensures accuracy by sourcing data directly from verified court records.

LIBIL uses AI to search verified court databases, offering a legal-first approach to background checks. Unlike traditional services, it provides real-time criminal background reports rooted in litigation data.

LIBIL is designed for legal teams, HR departments, compliance officers, BFSI institutions, investigative agencies, and enterprises that require reliable due diligence processes.

LIBIL uses data from over 10,000+ Indian courts, making the reports highly reliable and up-to-date. AI mapping reduces false positives and helps identify hidden links.

Yes. LIBIL offers API integrations for enterprises to conduct bulk verifications and streamline their onboarding or due diligence workflows.

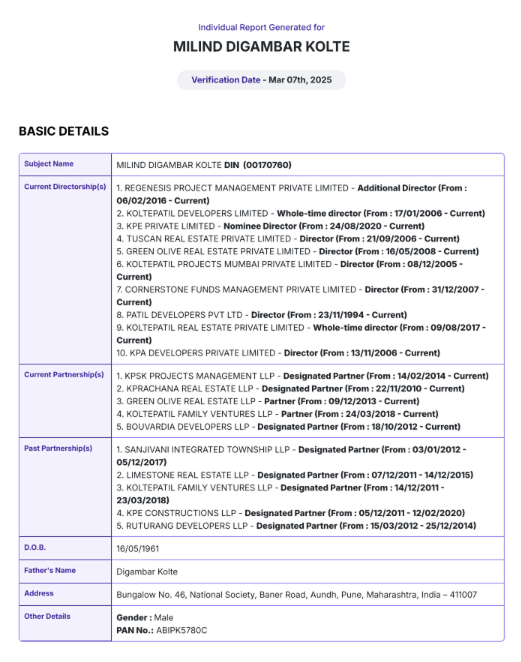

A typical report includes case numbers, parties involved, court jurisdictions, legal outcomes, and status—sourced from court records.

Absolutely. LIBIL is scalable and customizable to meet the needs of startups, SMEs, and large enterprises alike.

Creating a safe and trustworthy environment starts with informed hiring and onboarding decisions. Criminal background verification enables organizations to identify potential risks and maintain compliance standards.

For client evaluations, integrating client background verification creates a more comprehensive screening approach. Businesses involved in property or transaction heavy sectors can also align checks with real estate law firm software to support broader risk management strategies.