Why choose our client due diligence

-

Single source litigation coverage

searches Supreme Court, all High Courts, District Courts and major tribunals so you reduce blind spots that standard corporate searches miss. -

FIR and enforcement visibility

links FIRs, defaulter lists and regulator records with court matters to reveal enforcement exposure. -

Speed and auditability

use minute-level Instant Reports for screening and Detailed Reports for scored, narrative outputs suitable for audit trails and disclosure. -

Flexible delivery

Instant and Detailed APIs plus a self-serve client portal so you can embed client due diligence into any workflow. -

Enterprise controls

exportable PDF reports, case links and access logs to meet compliance and KYC recordkeeping requirements.

How client due diligence works

-

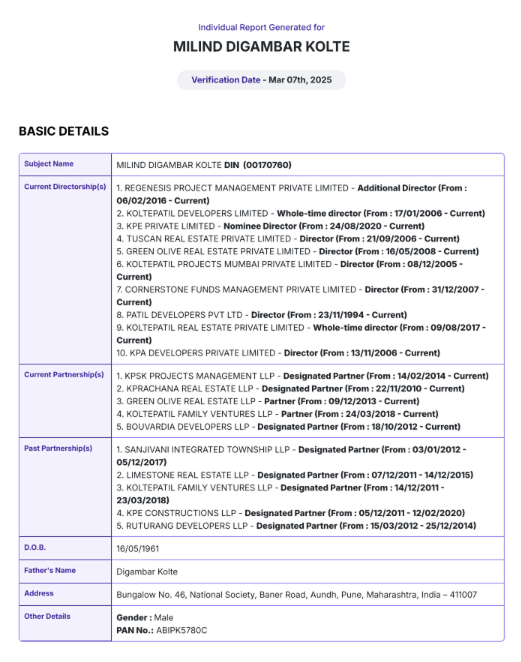

Provide identifiers such as name, and optionally father name, address, PAN or Aadhaar to improve precision.

-

Apply filters like state, district or court type when you need to narrow results.

-

Our system runs structured database searches together with live pulls from court systems and institutional sources. Matches are returned with case summaries and linked FIR or defaulter records where available.

-

Review the Instant or Detailed Report, export the PDF and attach the narrative to your onboarding or deal file. Escalate to manual review when necessary.

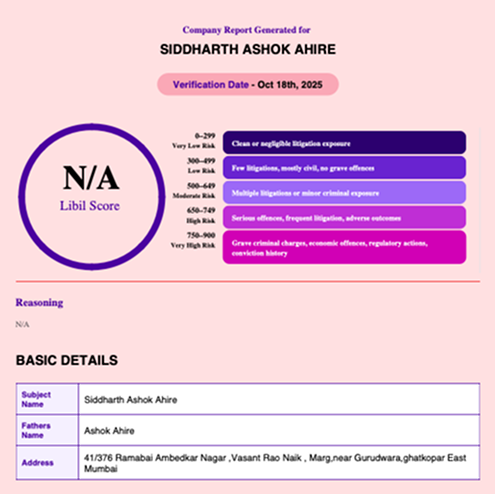

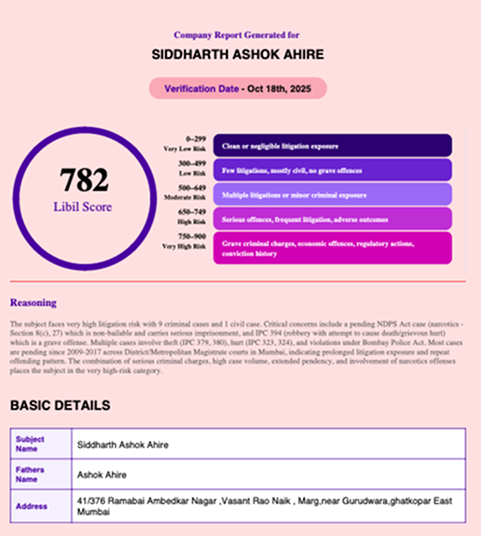

LIBIL - Litigation Check Reports

Instant Report

-

Best for: bulk onboarding, vendor screening, high throughput background checks.

-

Quick results in 1 to 2 minutes.

-

Basic case summaries and match indicators for immediate triage.

Detailed Reportt

-

Best for: compliance-critical hires, vendor risk escalation, investigative due diligence.

-

Includes LIBIL Score, case match scoring, narrative reasoning and detailed case summaries.

-

Typical turnaround is approximately 2 hours.

Manual Verification

-

Bespoke analyst-prepared reports for regulatory filings, IPO disclosure or deep investigations. Contact sales for scope and timelines.

Use cases for client due diligence

Onboarding and KYC for banking, NBFCs and payment platforms. Use Instant Reports for lead screening and Detailed Reports for large ticket or sensitive clients.

AML and financial crime investigations. Run Detailed Reports to map litigation exposure, FIRs and related parties.

Vendor and third party risk. Screen suppliers and partners and schedule periodic rechecks to keep risk profiles current.

M&A and transactional diligence. Use manual or Detailed Reports to populate litigation schedules and disclosure memos.

Credit underwriting and lending. Integrate LIBIL Score and case match metrics into credit memos and decision engines.

Trusted by the top names in the industry

Press & Recognitions

Ready to start client due diligence?

Qualified attorneys and legal experts employed by companies in India can request access to demonstrations and trials. Limited free trial spots are available. Provide your professional email address to receive priority access.

FAQs

Client due diligence is the process of verifying a client’s background, legal history, and potential risks before establishing a business relationship. It ensures regulatory compliance and protects businesses from fraud and litigation.

LIBIL scans massive legal databases to uncover a client's litigation history, legal disputes, and asset involvement. It automates background checks using AI and generates real-time, court-verified reports.

Yes. LIBIL is used by leading banks, NBFCs, law firms, and enterprise teams for risk assessments, onboarding, and legal verification.

Absolutely. LIBIL offers seamless API integration so your compliance team can access due diligence insights within your existing CRM or onboarding platforms.

Yes. All reports are generated from verified legal records sourced from over 10,000 courts across India, ensuring legal accuracy and compliance.

Most reports are generated instantly, allowing you to conduct comprehensive due diligence in under 5 minutes.

Yes. LIBIL is built for scale and can process bulk client data for large organizations and compliance teams.

Establishing trust with new clients requires accurate information and consistent screening. Client background verification helps organizations assess credibility, identify risks, and maintain compliance standards.

For regulated onboarding environments, combining processes with customer due diligence ensures a more structured evaluation framework. Companies that require deeper screening can also adopt criminal background verification to enhance risk visibility across engagements.