Smarter Litigation Checks & Case Tracking for Banks

In the banking industry, missing legal red flags can lead to fraud, loan defaults, or compliance penalties. Legitquest helps banks stay ahead with two advanced legal tech tools

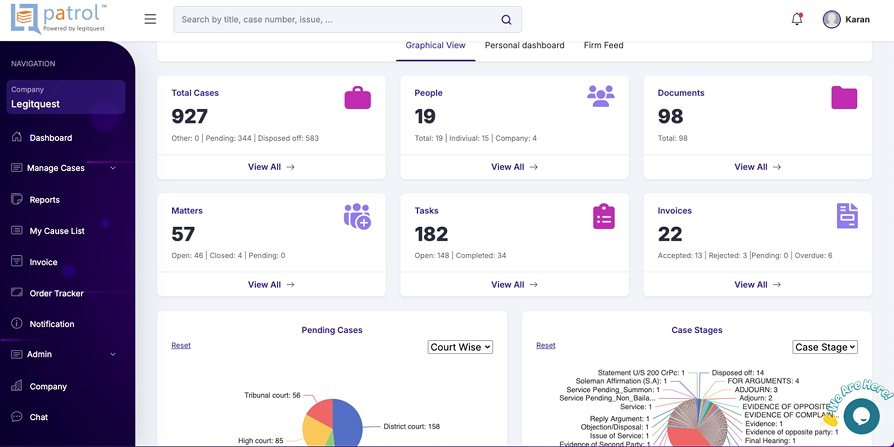

Case Management Tool for Banks

-

Legal case overload is a real problem for banks. With cases ranging from loan defaults to fraud disputes, manual handling wastes time and increases risk.

-

PATROL is an intelligent case management system designed for BFSI legal teams. It provides a centralized dashboard to track cases, access documents, receive updates, and manage court deadlines efficiently.

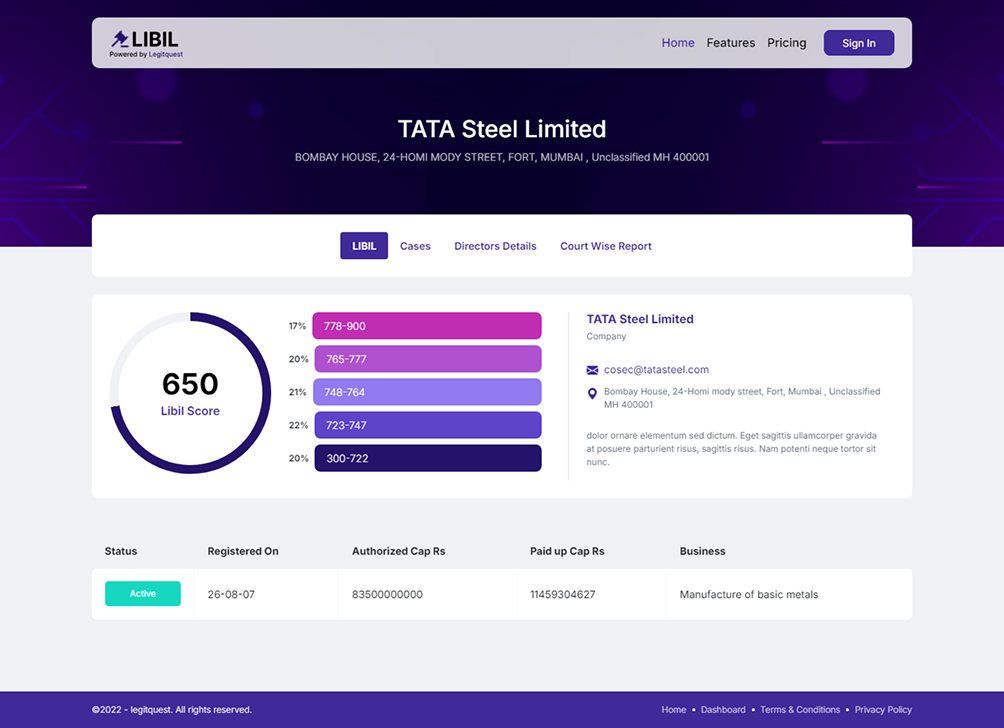

AI-Powered Litigation Check for Confident Banking Decisions

-

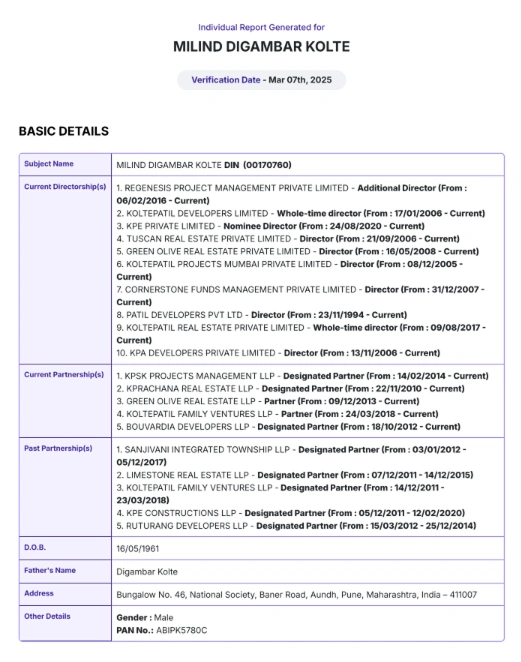

LIBIL is a legal due diligence tool that pulls real-time litigation data from 10,000+ courts and tribunals across India. It enables banks to make faster, safer lending and compliance decisions by identifying legal and compliance risks instantly.

-

Whether you’re processing loans, evaluating startups, or conducting customer due diligence, LIBIL delivers full-spectrum legal reports in minutes flagging ongoing cases, criminal records, and other red flags

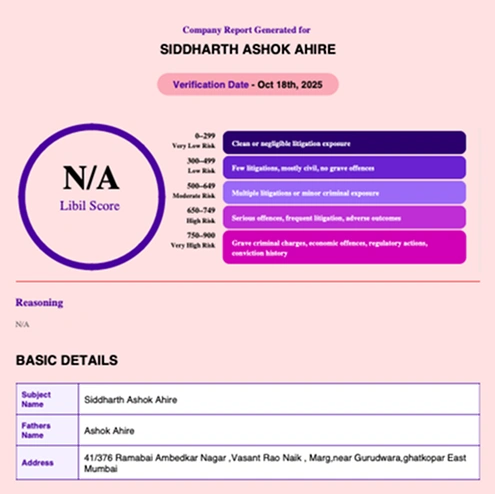

LIBIL - Litigation Check Reports

Instant Check

-

Best for: bulk onboarding, vendor screening, high throughput background checks.

-

Quick results in 1 to 2 minutes.

-

Basic case summaries and match indicators for immediate triage.

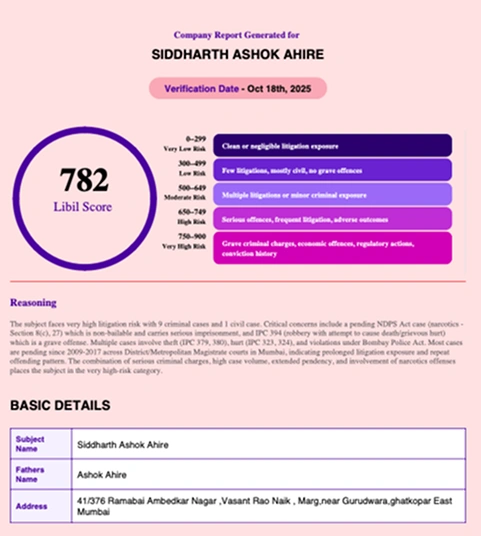

Detailed Report

-

Best for: compliance-critical hires, vendor risk escalation, investigative due diligence.

-

Includes LIBIL Score, case match scoring, narrative reasoning and detailed case summaries.

-

Typical turnaround is approximately 2 hours.

Manual Verification

-

Bespoke analyst-prepared reports for regulatory filings, IPO disclosure or deep investigations. Contact sales for scope and timelines.

Use cases in credit lending

Pre sanction underwriting

include litigation check outputs in credit memos and risk templates to avoid missed liabilities.

Ongoing portfolio monitoring

continuous surveillance for new filings, judgments or enforcement actions that change borrower risk.

Covenant breach and exception handling

create cases automatically on breach triggers, route tasks and record remediation steps.

Recovery and enforcement management

manage the lifecycle of recovery matters from notice to attachment and judgment execution.

Credit committee and audit packs

produce audit ready narratives, evidence extracts and timelines for regulatory and governance reviews.

Trusted by the top names in the industry

Press & Recognitions

Ready to add litigation checks and a case management tool to your credit workflows

FAQs

For Bank: LIBIL + PATROL by LegitQuest

Banks operate under continuous regulatory pressure where legal teams must manage compliance documentation and oversight efficiently. Legal tech for banks enables structured workflows that improve visibility and reduce manual effort across legal operations. This helps banking institutions respond quickly to regulatory requirements while maintaining accuracy.

Banking compliance often overlaps with financial and hiring risk. For institutions tracking exposure across regulations,legal tech for financial risk supports proactive monitoring and analysis. For hiring and vendor onboarding,legal due diligence for BGV adds an essential layer of verification.