The Emerging Menace of Financial Fraud

Financial fraud is evolving faster than many organizations can keep up with. In today’s digital economy, it is no longer just fake invoices or embezzlement. Fraudsters now use advanced accounting manipulations, shell companies, and even AI-based fraud to exploit financial systems. The consequences include risks to trust, reputation, and severe regulatory penalties.

For most organizations, manual audits, spreadsheet checks, and periodic reconciliations are no longer sufficient. Transactions happen in milliseconds, data volumes are massive, and global supply chains are interconnected. A single missed anomaly can escalate into a financial disaster.

Early identification is not just a compliance requirement—it is a survival strategy. The sooner an organization detects suspicious activity, the easier it is to prevent cascading losses and maintain stakeholder trust.

What Legal Intelligence Can Contribute

Legal intelligence combines data analytics with legal and regulatory insights to help organizations make informed, compliant, and timely decisions. Unlike traditional fraud detection systems that only consider numbers, legal intelligence provides context by analyzing the legal, contractual, and regulatory environment of financial activities. This broader perspective helps compliance teams see patterns that might otherwise remain hidden.

How Legal Intelligence Assists in Fraud Detection

- Monitoring litigation and disputes: Regularly track litigation to identify early signs of abuse or financial anomalies involving key partners or subsidiaries.

- Identifying compliance gaps: Compare transactions against laws and regulations to find potential areas of non-compliance.

- Analyzing agreements for hidden risks: AI-based document analysis can detect suspicious clauses, unmentioned third parties, or non-standard payment terms.

- Cross-referencing legal and financial data: Integrating court records, regulatory filings, and internal information highlights inconsistencies indicative of potential fraud.

Legal intelligence provides the context for financial activity, helping investigators distinguish legitimate transactions from potentially fraudulent ones.

The Role of Advanced Tools in Early Detection

Modern AI-driven legal intelligence systems are transforming how organizations detect and respond to fraud. These tools do more than collect data—they constantly analyze, learn, and adapt.

Key Capabilities

- Real-Time Monitoring: Transactions and communications are scanned in real-time, enabling compliance teams to act immediately on suspicious activity.

- Pattern Recognition: AI detects anomalies in transaction timing, repeated counterparties, or irregular reporting that humans might miss.

- Risk Scoring and Prioritization: Not every anomaly signals fraud. Risk scores help prioritize investigations, focusing attention on the most critical issues.

- Integration with Legal and Regulatory Data: Combining transactional data with litigation histories, sanctions lists, and regulatory updates gives a holistic view of exposure and accountability.

- Predictive Analytics: Machine learning models forecast emerging risks based on historical fraud patterns, enabling proactive prevention.

This proactive, data-driven approach allows organizations to shift from reactive defense to strategic prevention—a paradigm shift in corporate risk management.

Corporate Compliance Team Benefits

Advanced legal intelligence tools offer practical advantages to compliance officers, auditors, and risk managers:

- Quick reaction to suspicious activity: Dashboards and automated alerts reduce the time between detection and action.

- Minimized human error: Automation provides consistency and reduces subjectivity.

- Enhanced regulatory compliance: Tools align with AML, KYC, and FATF guidelines, simplifying reporting.

- Improved internal controls: Continuous monitoring strengthens policies and governance structures.

- Increased stakeholder confidence: Transparency and responsiveness build trust among investors, partners, and regulators.

Essentially, legal intelligence transforms compliance teams from oversight-driven to insight-driven.

Industry Applications and Real-World Use Cases

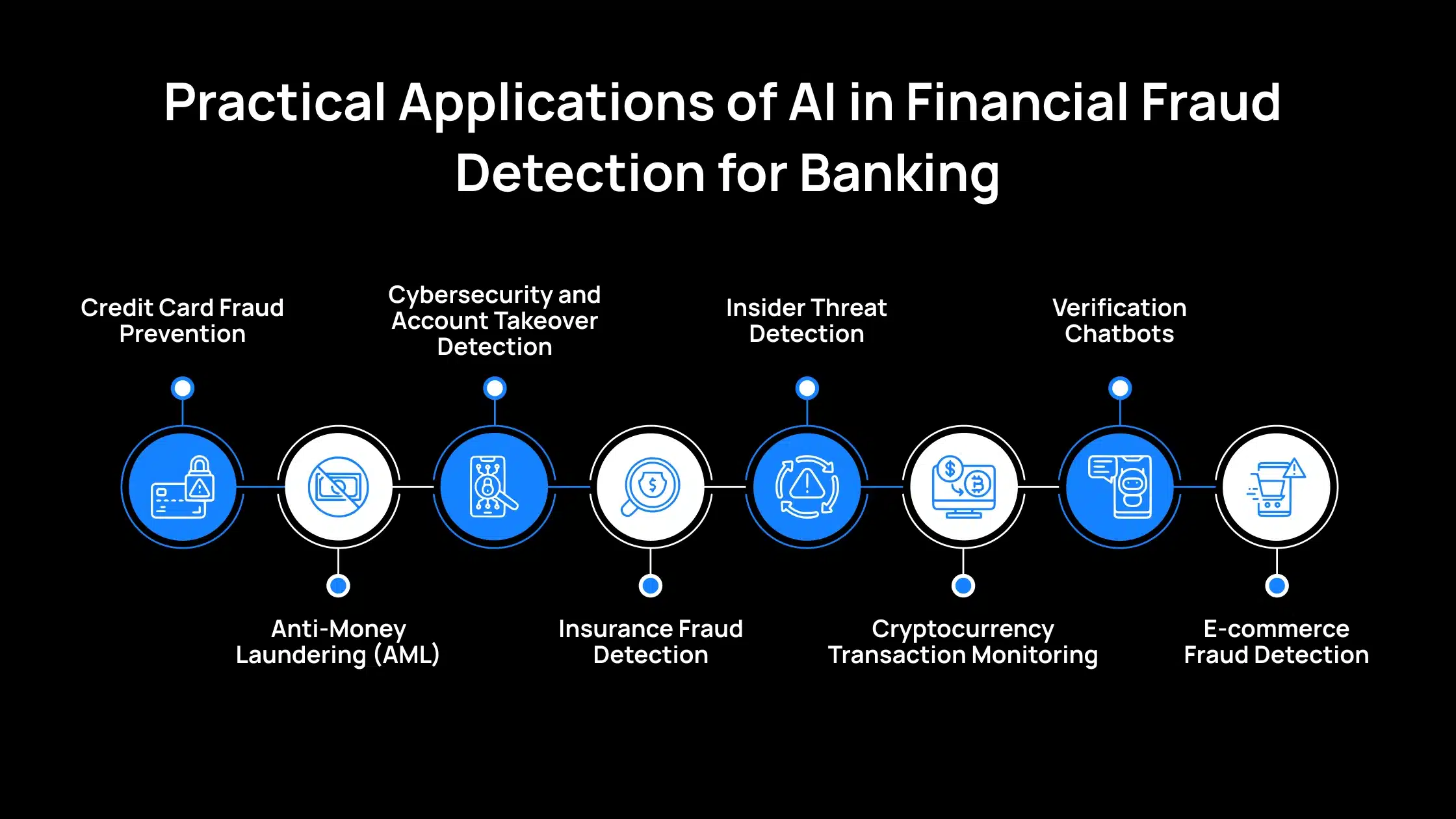

AI-powered legal intelligence is already being applied across industries:

- Financial institutions use it to detect suspicious money transfers and enforce anti-money-laundering regulations.

- Corporate compliance teams identify risks of kickbacks and shell company activity.

- Regulatory agencies detect linked fraud rings and transnational anomalies.

- Multinational companies assess exposure across jurisdictions with differing legal norms.

For example, an international bank can integrate legal intelligence into its transaction monitoring system. If a client involved in ongoing litigation attempts a large transfer, the system flags it automatically, preventing possible money laundering or insider fraud.

This integration of financial forensics and legal analytics is transforming how institutions combat white-collar crime at scale.

Why Early Fraud Detection Enhances Compliance

Detecting financial fraud early preserves integrity and prevents cascading losses, safeguards brand reputation, and demonstrates responsibility to regulators and clients. Early intervention allows organizations to self-report potential issues before they escalate into investigations or sanctions, minimizing legal liability.

By using a shared intelligence platform, compliance, legal, and risk teams gain a unified view, enabling faster, aligned decision-making. This transforms compliance from a cost center into a strategic advantage.

The Future of Financial Fraud Detection: AI Meets Legal Insight

As fraudsters adopt sophisticated technologies, organizations must do the same. The future lies in integrated ecosystems combining financial analytics, legal intelligence, and AI-based prediction.

Platforms like LegitQuest LIBIL exemplify this evolution, helping organizations detect, analyze, and prevent financial fraud by integrating AI, legal data analytics, and intuitive dashboards. They enable compliance professionals to identify hidden risks, maintain regulatory alignment, and strengthen governance—all within a single interface.

Early fraud detection isn’t just about safeguarding numbers—it’s about protecting people, trust, and organizational integrity. With advanced legal intelligence tools, businesses can see clearly, act swiftly, and build stronger defenses for the future.